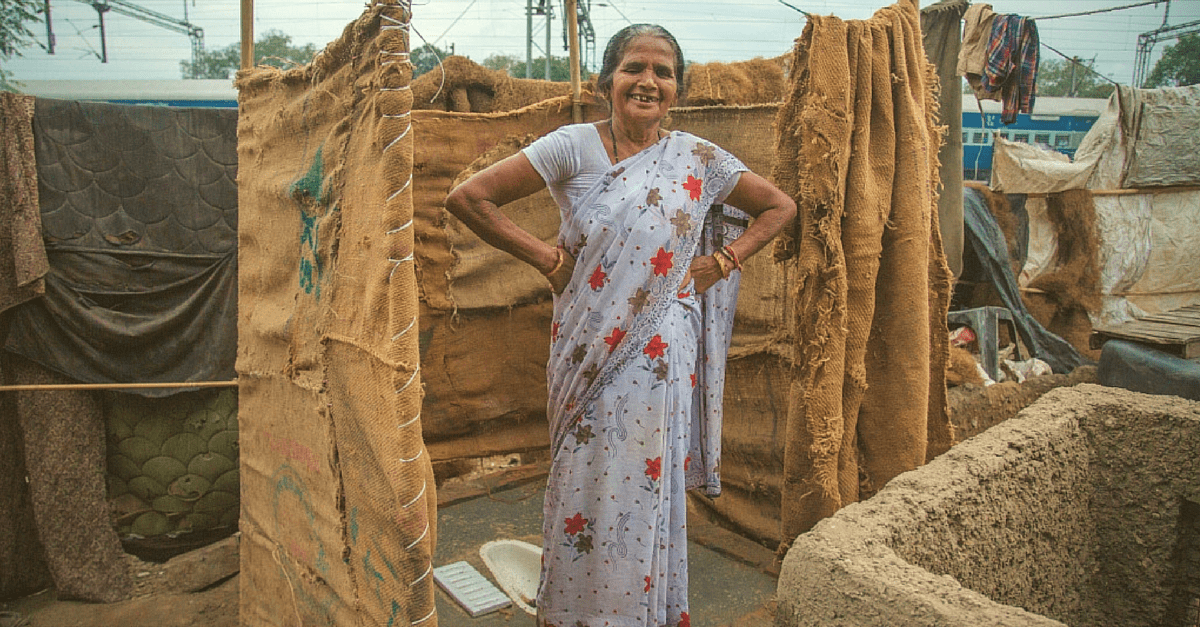

.jpg) F. M. Britto

F. M. Britto

The 14 year old newly-married bride left her house in Sitapur to stay with her 18 year old husband in a Kanpur slum, Uttar Pradesh. Kalavati Devi was disgusted to notice everyone in her Raja ka Purwa slum releasing themselves in the streets. “If someone were to draw a picture of hell, that slum would perfectly fit,” she commented.

She shared her idea of building latrines in her area. Her husband Jairaj Singh agreed to cooperate with her.

When they approached the Kanpur Municipal Corporation, the commissioner was ready to offer them two lakh rupees to build a community latrine, provided that the community contributes another one third of that amount.

But the 700 families living there, consisting of poor rickshawalahs, domestic servants and the daily wagers, were unwilling to contribute any money or even free labour and not even the place. Not feeling the necessity for latrines, they wished to continue their age-old practice. They were also suspicious of the motives behind the initiative.

The illiterate Kalavati went house to house and convened community meetings, explaining to the people how the area gets polluted, contagious diseases increase and the dangers their young daughters and old people have to face every day.

Seeing her enthusiasm, the Shramik Bharti, an NGO where her husband worked as a floor cutter, volunteered to donate that extra money. Some local people also came forward to contribute. With all their cooperation, finally she constructed 50-seat community latrine there.

Not content with that, Kalavati wished the entire Kanpur area defection-free.

More than raising the fund and organizing the work, she herself wanted to become the mason. Meanwhile Kalavati lost her husband and a son-in-law. So she had to become the bread-winner of her family to support herself and her widowed daughter Lakshmi with her two children. What was her passion once has become a necessity now.

Shramik Bharti that works with sanitation sent her for training in toilet construction. She has developed her own sewer design and construction techniques. As the mother of two married daughters, she herself has become the chief mason to build more community latrines.

The 55 year old unschooled woman feels proud today to have built more than 400 latrines in the nearby area with the financial aid of the UK-based charity Water Aid.

She is also determined to get toilets made in each and every household, especially in the slum and the lower income neighbourhoods. She also motivates people to use them.

Kalavati says, “By constructing toilets I am ensuring a clean environment, and also saving the dignity of women and girls. I sincerely believe no other work could be as meaningful as what I am doing now.”

Neurobion Forte recognized her as a true unsung hero. During the International Women’s Day in 2020 the Indian President Ram Nath Kovind honoured Kalavati, with the Nari Shakti Award, the highest award for women, in New Delhi.

“Twice as many people in India have access to cell phones as to latrines.” –John Brockman